STOCK UPDATE Esab India Result highlights Ashok Leyland Sales drop in February Key points

Recommendation: Buy

Price target: Rs575

Current market price: Rs460

Recommendation: Hold

Price target: Rs43

Current market price: Rs35

Live Online Trading News, Live Online Stock Prices NSE, BSE, Live Online Stock Recommendations

www.mReach.net ... for Live TV, Radio & FM channelswww.mReach.netFor Live TV, Radio & FM channels |

Live BSE Live NSE

|

Tuesday, March 11, 2008

Stock Recommendation: 2

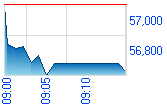

For Q4CY2007, ESAB India reported a growth of 11.5% in the net sales to Rs87.7 crore, which was below our expectation.

The consumables division reported a growth of 14.3% year on year (yoy) to Rs62.6 crore. The profit before interest and tax (PBIT) for the division grew by 37.8% to Rs16.5 crore. The equipment division reported a dismal performance with revenues growing by only 5.2% to Rs25.1 crore, while the PBIT for the division grew by 13.2% to Rs4.7 crore.

The operating profit for the company grew by 33.2% to Rs19.2 crore. The operating performance of the company continues to be healthy and the margin reported an improvement of 350 basis points yoy to 21.9%.

The other income grew by 8.1% to Rs2.5 crore.

The interest cost declined by 22.2% to Rs0.2 crore, while the depreciation charge rose by 13% to Rs1.6 crore. Consequently, the net profit grew by 31.4% to Rs13.3 crore.

For the full year, ESAB India reported a growth of 19.4% to Rs342.9 crore in the revenues. The operating profit grew by 23% to Rs80 crore resulting in an improvement of 70 basis points in the operating profit margin (OPM) to 23.3%.

The net profit for the year grew by 25.1% to Rs53.4 crore against our full year estimates of Rs57.4 crore.

We believe, the demand for welding products would continue to be buoyant due to the planned investments in core infrastructure sectors like roads, ports, airports, construction and the other industrial sectors in India. ESAB India, the market leader in welding products, is all set to tap this opportunity. Currently, we maintain our estimates for CY2008 and would bring our CY2009 estimates post the annual general meeting (AGM) of the company.

At the current market price, the stock trades at 10.3x its CY2008 earnings per share (EPS) and 5.2x enterprise value (EV)/earnings before interest, depreciation, tax and amortisation (EBIDTA). We maintain our Buy recommendation with a price target of Rs575.

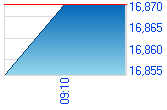

Ashok Leyland's total vehicle sales during February 2008 declined by 6.7% to 7,501 units from 8,036 units in the same month a year ago. Sales in the domestic market declined by 7.2%, whereas exports were marginally down by 0.9% for the same month. On a month-on-month basis, the total sales declined by 17.7%, taking the year-till-date sales volume down by 2.7%.

Passenger or bus sales grew marginally by 1.1% year on year (yoy) to 1,690 vehicles. The growth has come from exports, which grew by 17.8% to 443 vehicles.

Truck sales declined by 9.5% to 5,743 vehicles. The domestic sales declined by 8% yoy to 5,554 vehicles whereas exports dropped by 38% to 189 vehicles.

The decline in truck sales is attributed to the postponement of purchases in anticipation of an excise duty cut in the budget.

The management has decided to pass on the benefit of a reduction in the excise duty on buses from 16% to 12% and of the cut in the cenvat on trucks from 16% to 14%. Earlier, Ashok Leyland had announced a price hike of 2.5% in end February 2008. Subsequent to the pass-on of the benefit of the lower duty on trucks, the effective price increase will be only to the extent of 1%.

We maintain our volume estimate at 83,200 for FY2008. However, the management continues to be confident of closing the year with sales of 85,000 plus vehicles.

The outlook for the commercial vehicle industry is expected to be weak for one more quarter. From May/June onwards the base effect should come into play. We maintain Hold on the stock

Labels:

Company Info,

Stock Recommendations

Please note: Some of the content in this site is from Share khan emails sent to its customers.