STOCK UPDATE Aban Offshore Riding high on offshoring upcycle Key points Ahmednagar Forgings Book out Result highlights Andhra Bank Showing signs of improvement Result highlights Bank of India Price target revised to Rs458 Result highlights Bharat Bijlee Price target revised to Rs3,792 We met the management of Bharat Bijlee Ltd (BBL) and bring to you the key highlights of our discussion. Key highlights BL Kashyap & Sons Price target revised to Rs1,827 Result highlights Cadila Healthcare Price target revised to Rs368 Result highlights Ceat Results in line with expectations Result highlights Corporation Bank Lower provisions boost PAT Result highlights Crompton Greaves Price target revised to Rs423 Key points Deepak Fertilisers & Petrochemicals Corporation Price target revised to Rs169 Result highlights Grasim Industries Price target revised to Rs3,853 Result highlights HDFC Bank Price target revised to Rs1,747 Result highlights Hindustan Unilever Back with a bang! Result highlights ICI India Lower other income dampens profit growth Result highlights Jindal Saw Entering new territories Result highlights Mahindra Lifespace Developers Q3FY2008 results—in line with expectation Result highlights Mold-Tek Technologies Price target revised to Rs197 Result highlights Navneet Publications (India) Results ahead of expectations Result highlights

Recommendation: Buy

Price target: Rs5,420

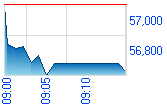

Current market price: Rs3,812

excellent Q4 numbers (December-ending) and has also indicated continual buoyancy in the deep-water and jackup rigs market. The demand and rates for jackup rigs have positively surprised the company and is likely to remain strong through the first half of this year.

Recommendation: Book Out

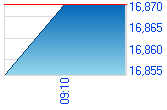

Current market price: Rs203

Recommendation: Buy

Price target: Rs117

Current market price: Rs91

Recommendation: Buy

Price target: Rs458

Current market price: Rs364

Recommendation: Buy

Price target: Rs3,792

Current market price: Rs2,848

Recommendation: Hold

Price target: Rs1,827

Current market price: Rs1,801

Recommendation: Buy

Price target: Rs368

Current market price: Rs255

Recommendation: Buy

Price target: Rs250

Current market price: Rs181

Recommendation: Buy

Price target: Rs542

Current market price: Rs312

Recommendation: Buy

Price target: Rs423

Current market price: Rs313

Recommendation: Buy

Price target: Rs169

Current market price: Rs118

Recommendation: Buy

Price target: Rs3,853

Current market price: Rs2,736

Recommendation: Buy

Price target: to Rs1,747

Current market price: Rs1,548

Recommendation: Buy

Price target: Rs280

Current market price: Rs203

Recommendation: Buy

Price target: Rs581

Current market price: Rs495

Recommendation: Buy

Price target: Rs1,302

Current market price: Rs904

Recommendation: Buy

Price target: Rs1,096

Current market price: Rs629

Recommendation: Buy

Price target: Rs197

Current market price: Rs103

Recommendation: Hold

Price target: Rs120

Current market price: Rs115

Live Online Trading News, Live Online Stock Prices NSE, BSE, Live Online Stock Recommendations

www.mReach.net ... for Live TV, Radio & FM channelswww.mReach.netFor Live TV, Radio & FM channels |

Live BSE Live NSE

|

Wednesday, March 12, 2008

Stock Recommendations: 3

With the oil crossing the $100 barrier and the limited scope for increasing the output from the existing assets, the global E&P expenditure is on a rise and the upcycle is likely to continue.

The day rates for jackup rigs have remained firm, and looking at the tight demand-supply scenario and high utilisation levels (which is expected to be 95%+ for the next two years), the rates are expected to remain strong inspite of new additions in the next couple of years.

Transocean Inc the world's largest offshore oil and gas driller has reported

Factoring in the impact of the recent deployment of the company's drillship Aban Ice at higher rates, we are raising our earnings estimates for FY2009E by 1.9% to Rs398.9 and FY2010E by 1.5% to Rs513.8. We are also reducing our estimates for the current fiscal by 11.8% on the back of lower number of operating days for one of its rig Aban VI and no announcement on the deployment of the recently acquired rig Bulford Dolphin.

At the current market price of Rs3,812, the stock is discounting its FY2009E earnings by 9.6x and FY2010E earnings by 7.4x. We believe that the valuations are extremely attractive and maintain our Buy recommendation on the stock with a price target of Rs5,420.

The Q2FY2008 results of Ahmednagar Forgings Ltd (AFL) are below our estimates.

The company's sales for the quarter grew by only 8.8% to Rs165.8 crore. The domestic sales remained flat at Rs111 crore and the export sales grew by 30% to Rs54 crore. The export revenues were flat on a quarter-on-quarter (q-o-q) basis.

The operating profit margin (OPM) has been maintained at 20.6%. As a result, the operating profit grew by 8.5% to Rs342 crore. Higher interest and depreciation costs led the profit after tax (PAT) to remain flat at Rs17.7 crore.

The ramp up in exports is not happening, as expected There has been a delay in product approvals for exports. The domestic revenues are also not growing due to a slowdown in the domestic market.

AFL is making preferential allotment of 17 lakh shares and 38 lakh warrants to its promoters at a price of Rs240, thereby raising Rs132 crore. The funds will be used in buying assets such as forging lines. The preferential allotment would lead to an equity dilution of 16%. The resolution to raise money through debt of Rs2,000 crore has also been cleared.

Slow ramp up in exports, slow down in domestic market and 16% equity dilution would be a dampener on AFL's performance. We downgrade our earning estimates for FY2008 and FY2009 by 25% to Rs16.3 and Rs20.6 respectively. At the current market price of Rs203, the stock is trading at 9.9x its FY2009E earnings and is available at an enterprise value (EV)/earnings before interest, depreciation, tax and amortisation (EBIDTA) of 6.0x. We advise investors to Book out of the stock.

Andhra Bank reported its Q3FY2008 results with the net profit going up by 16.7% year on year (yoy) and 5.2% quarter on quarter (qoq). The year-on-year (y-o-y) growth was driven by higher other income (up 29.3%) and lower staff expenses (down by 17.8%). The core performance was better than that of last quarter (Q2FY2008) with the net interest margin (NIM) improving slightly due to a slim reduction in the cost of deposits.

The bank's advances grew 22.7% yoy and 2.7% qoq with the net interest income (NII) going up by 1.8% yoy and 7.4% qoq. Our calculations suggest that the bank's NIM improved by 10 basis points qoq mainly due to the increase in the yield on advances (7 basis points) and a reduction in the cost of deposits (10 basis points). An increase of 290 basis points qoq in the low-cost savings account and current account (CASA) deposit base helped matters.

The non-interest income grew by 11.1% yoy to Rs147.7 crore due to a 258.7% jump in the treasury income, while the core fee income showed a decline of 3.7% yoy. The fall in the core fee income is a cause for concern though the management expects this to improve going forward with an increase in the income from distribution of third party products.

The operating expenses fell by a moderate 2.6% yoy helped by a 17.8% fall in employee costs, which is in contrast to other public sector unit (PSU) banks. The main reason for the fall in the employee costs is the bank's decision to adjust the transitional liability on account of AS-15 (amounting to about Rs375 crore) against the reserves. Upto Q2FY2008 the bank used to make an adhoc provision for this liability.

This coupled with a 4.3% y-o-y growth in the net total income resulted in a moderate growth of 10.5% yoy in pre-provisioning profits. Provisions were lower at Rs 27.8 crore due largely to a write back of investment depreciation (Rs15 crore) and lower standard asset provision.

Andhra Bank's business grew quite strongly with the advances up by 22.4% yoy. The deposits mirrored the advances growth going up by 21.6% yoy. The deposits were down 1.2% qoq, which is an indication of the bank giving up some of the high-cost deposits.

Despite the strong growth in the advances, the asset quality continued to remain among the best in the industry with the gross non-performing assets (GNPA) at 1.35% and the net non-performing assets (NNPA) at 0.16%.

As these quarterly results indicate, the pressure on margins is easing and the situation should improve going forward. The capital adequacy levels are comfortable at 12.03% with the Tier-I capital adequacy ratio (CAR) at around 8-9%, which is not a constraint on growth. The asset quality continues to remain among the best in the industry. At the current market price of Rs91, the stock is quoting at 6.3x its FY2009E earnings per share (EPS), 3.4x pre-provision profits (PPP) and 1.1x book value (BV). The stock is available at attractive valuations given its low price to book multiple compared with its peers. We maintain our Buy call on the stock with a price target of Rs117.

Bank of India (BoI) reported a profit after tax (PAT) of Rs511.9 crore for Q3FY2008, which was up by a whopping 101.0% year on year (yoy) and 20.4% quarter on quarter (qoq). The PAT beat our and consensus estimates by a significant margin. The strong PAT growth was on the back of robust interest income growth, spike in the non-interest income led by treasury gains and contained operating expenses.

The net interest income (NII) during the quarter grew by 25.7% yoy to Rs1,079.5 crore. The NII growth was mainly due to a continued strong growth in the advances and an improvement in the net interest margin (NIM).

The reported NIM of 3.14% during the quarter reflects an improvement of 10 basis points yoy from 3.04% for the year-ago period. The NIM improvement was mainly due to improvement in the yields on advances (115 basis points) and the investments (105 basis points), which outweighed the 83 basis points year-on-year (y-o-y) increase in the cost of funds.

During the quarter, the advances grew by a strong 30% yoy to Rs 103,657 crore indicating an uptick in the credit off take compared with that of H1FY2008. The growth in the advances was led by a strong growth in the foreign advances (up 32.7%). Meanwhile the deposits grew by 27.4% yoy to Rs135,835 crore on the back of a 36% y-o-y growth in the term deposits and a 32.5% y-o-y growth in the current account deposits. However, due to a higher growth in term deposits, the current account and saving account (CASA) ratio declined to 37% from 40.7% a year ago.

The non-interest income witnessed a huge growth of 72% yoy to Rs554.1 crore. The growth in the non-interest income was primarily due to the spike in the treasury gains, which were up 109% yoy. Meanwhile the fee income grew by a strong 46% yoy and 40.7% qoq.

Notably, the operating expenses were up by only 5.5% yoy, whereas it declined by ~2% qoq to Rs662.2 crore, partly because of a higher base for the year ago period. The lower operating expenses growth can be traced to the decline in the other operating expenses (down 13% yoy), while the staff expenses were up 17% yoy. As a result of the lower operating expenses and the strong income growth, the cost-income ratio improved significantly to 40.5% compared with 50.6% for the year-ago period.

Asset quality during the quarter continued to improve yoy, with a 10% y-o-y decline in the gross non-performing assets (GNPA) to Rs1,969.3 crore and a 29.5% decline in the net non-performing assets (NNPA) to Rs633.5 crore.

Capital adequacy remains healthy with capital adequacy ratio (CAR) at 12.5% at the end of December 2007, compared with 11.7% at the end of December 2006.

At the current market price of Rs364, the stock trades at 8.8x its 2009E earnings per share (EPS), 4.4x its 2009E pre-provisioning profit (PPP) and 1.9x its 2009E book value (BV). We maintain our Buy recommendation on the stock with a revised twelve-month price target of Rs458.

Q3FY2008 results of Bharat Bijlee Ltd (BBL) were below our and street expectations, as the production during the quarter was disrupted due to capacity expansion being undertaken by the company.

BBL is expanding its transformer manufacturing capacity to 11,000 Mega Volt Ampere (MVA) from 8,000MVA. The enhanced capacity is expected to come on stream by April 2008.

We expect the revenues to pick up in Q4FY2008 as the inventory build-up during the quarter should be cleared by then and hence we maintain our full year's revenue estimates.

We are also incorporating our FY2010 earning estimates and expect the revenues and profits to grow at a compounded annual growth rate (CAGR) of 27.9% and 33.4% respectively over FY2007-10E.

The current order book stands at Rs400 crore and is executable over the next 10-12 months period.

The reported revenues of BL Kashyap & Sons (BLK) during Q3FY2008 grew by 71.8% year on year (yoy) to Rs405.8 crore.

The operating profit margin (OPM) improved by 111 basis points to 11.7% during the quarter under review. Consequently, the company's operating profit grew by 89.8% yoy to Rs47.4 crore during the quarter.

Higher interest and tax expenses restricted the bottom line growth. The interest expenses increased as the debt rose to Rs91 crore in Q3FY2008 from Rs60 crore in the previous quarter. Furthermore, the company's effective tax rate also increased to 40.1% in Q3FY2008 from 34.3% in the corresponding period last year (Q3FY2007). Consequently, the company's bottom line grew by 63.9% yoy to Rs25.2 crore, which was below our expectation of Rs30 crore.

The order backlog stood at around Rs1,850 crore in the third quarter. Commercial projects contributed around 78% to the total order book followed by industrial projects (15%) and residential projects (7%). These projects are expected to be executed over the next 15-18 month period.

At the current market price, the stock trades at 19.0x FY2009 and 14.8x FY2010 estimated earnings after adjusting for the real estate subsidiary value. We are rolling over our target multiple to FY2010 estimated earning and value the stock at Rs1,827 based on the sum-of-the-parts (SOTP) valuation. Although the stock appears to be fairly valued at the current market price, we recommend Hold on the stock, as BLK's negotiation to dilute its stake in the real estate subsidiary could bring surprise and provide more upside than our estimates.

Cadila Healthcare (Cadila)'s total operating income (consolidated) grew by a 22.7% year on year (yoy) to Rs579.4 crore in Q3FY2008. The sales were in line with our estimate and were driven by a 14.9% growth in the domestic business and a 40.4% growth in the exports.

While the domestic formulation business continued to remain sluggish during the quarter, the improved performance of the French business (a growth of 14.9% yoy) and the US business (a growth of 47.4% yoy) contributed largely to the robust growth in the exports. The company has already garnered ~$45 million in revenues from the US generic business in M9FY2008 and is well placed to exceed its guidance of $50 million for FY2008. We have modeled $55 million in US generic sales in FY2008 and $70 million in FY2009.

The prospects of Cadila's joint venture (JV) with Altana have been uncertain, with generic companies entering the market. This is already evident in Q3FY2008 as the revenues and profits of this JV dropped by 32% sequentially in Q2FY2008 and by 43% sequentially in Q3FY2008. The management has indicated that the expected loss of profits due to the generic entry in Pantoprazole would be to the tune of Rs17-18 crore in FY2009. On the other hand, Wyeth's (Altana's partner in the USA) appointment of an authorised generic player increases the JV's prospects, as the JV would be supplying the Pantoprazole active pharmaceutical ingredient (API) to the authorised generic player. We have conservatively modeled revenues of only $28 million in FY2008 and of $20 million in FY2009 for the JV. Any positive outcome from the ongoing talks between Cadila and Altana would be an upside to our estimates.

Cadila's operating profit margin (OPM) expanded by 50 basis points to 17.9% in Q3FY2008. The expansion in the margin was largely due to a 170-basis-point improvement in the raw material cost. Consequently, the operating profit grew by 25.8% to Rs103.5 crore in Q3FY2008.

The pre-exceptional net profit grew by 13.2% to Rs524 crore due to a 27.4% rise in the depreciation (on account of acquisitions) and a 780-basis-point increase in the tax incidence. The net profit was below our estimate of Rs62 crore. The earnings for the quarter stood at Rs4.2 per share.

Cadila's JV with Hospira for oncology injectables seems to be on track to start contributing from FY2009 onwards. The management has indicated that the JV will generate Rs150 crore in revenues in FY2009. However, we have built in only Rs100 crore into our estimate (of which Cadila's share will be Rs50 crore).

In view of the slower than expected ramp-up in the domestic formulation business and the reduced revenue and profit potential of the Altana JV (due to generic entry), we are downgrading our numbers for Cadila. Further, we are also incorporating the revised guidance provided by the management on the revenue potential of the Cadila-Hospira JV from FY2009 onwards. We have revised downwards our FY2008 and FY2009 earnings estimates by 12.0% and 12.5% respectively to Rs19.7 per share in FY2008 and Rs23.0 per share in FY2009.

Cadila's stock price has seen a significant correction over the past two weeks. We believe the current price more than factors in the genericisation of Pantoprazole. At the current market price of Rs255, the stock is available at attractive valuations of 12.9x our FY2008 and at 11.1x our FY2009 estimated earnings. We reiterate our Buy recommendation on Cadila with a revised price target of Rs368 (16x FY2009E earnings).

Ceat's Q3FY2008 performance was in line with our expectations.

The net sales grew by 5.1% to Rs564.1 crore due to lower production owing to festive holidays during the quarter and a slowdown in original equipment manufacturer (OEM) sales, which declined by 26.6% year on year (yoy). Replacement sales continue to be strong and rose by 21.9% during the quarter.

The operating profit margin (OPM) remained stable at 7.4% against 7.3% in the same quarter of the last year but declined significantly on a sequential basis from 9.4% in Q2FY2008 due to lower production and rising raw material prices, particularly rubber prices. Consequently, the operating profit grew by 7.1% to Rs41.8 crore.

A higher other income for the quarter at Rs8.3 crore, lower interest cost and stable depreciation charge led to a 63.2% rise in the net profit to Rs19.2 crore.

The land sale at its Bhandup plant is expected to be complete by Q4FY2008 and the company would gradually sell the whole plant and shift the operations to Patalganga.

Considering the continued buoyancy in the replacement market and strong opportunities in the specialty tyre segment, we maintain our positive outlook on Ceat. On back of very strong performance in the first nine months, strong margins and higher other income, we upgrade our FY2008 earnings estimate by 16.9% to Rs24.3 and expect the company to record a 10.4% top line growth in FY2009.

At the current market price of Rs181, the stock is trading at 6.9x its FY2009E earnings and an enterprise value (EV)/earnings before interest, depreciation, tax and amortisation (EBIDTA) of 3.1x. We maintain our Buy recommendation on Ceat with a price target of Rs250.

Corporation Bank reported a lacklustre set of numbers for Q3FY2008, though the profit after tax (PAT) indicates a strong growth of 30.4% year on year (yoy) and 18.3% quarter on quarter (qoq) to Rs191 crore.

The net interest income (NII) stood at Rs334 crore, up 6% yoy was down 6% qoq. The disappointing NII was mainly due to the contraction in the net interest margin (NIM).

During Q3FY2008 the calculated NIM witnessed a 31 basis points decline yoy, mainly due to higher cost of funds, which outweighed improvement in yield on investment and advances.

The non-interest income registered a subdued growth of 4.8% yoy, while declining 8.8% qoq to Rs167 crore. During the quarter, the fee income registered a strong growth of 24.5% yoy, which was outweighed by a passive performance in treasury gains and recoveries.

Further, the operating expenses grew by 11.8% yoy to Rs223 crore. The higher operating expenses can be traced to a 23% year-on-year (y-o-y) increase in the staff expenses, while other operating expenses were up marginally by 2% yoy to Rs108 crore.

Disappointing NII growth, subdued non-interest income and higher operating expenses led to a lacklustre growth of 1.1% yoy in the operating profit, while on a quarter-on-quarter (q-o-q) basis it declined by 5.8%.

Notably, provisions of Rs9.7 crore for the quarter were down significantly by 88.3% yoy and 82% qoq, which surprised us. The lower provisioning helped the bank report a healthy PAT growth.

Asset quality continued to improve as reflected by a 4.2% decline in the gross non-performing assets (GNPA) to Rs598.5 crore and a 17.7% decline in the net non-performing assets (NNPA) to Rs112.3 crore.

At the current market price of Rs312, the stock is quoting at 5.8x FY2009E earnings per share (EPS), 3.0x FY2009E pre-provision profits (PPP), and 0.9x FY2009E book value (BV) We maintain our Buy recommendation on the stock with price target of Rs542.

The M9FY2008 performance of Crompton Greaves Ltd (CGL) has been below our expectations. The power system business of the company displayed sluggish growth in its revenues. While in Q2 the revenue growth saw a set back due to a fire in a transformer plant, the Q3 revenues grew by only 13.1% due to logistical problem and delay in the delivery of orders.

In the recent conference call, the management of the company has guided for a revenue growth of 19% in the power business, 20% in the industrial business and 15% in the consumer business in FY2008. The guidance was below our earlier estimates, leading us to the downgrade our estimates.

In this report, we are also introducing our FY2010 earning estimates and expect CGL revenues and profits to grow at a compounded annual growth rate (CAGR) of 21.6% and 33.7% respectively over FY2007-10E.

The standalone order book of the company remained flat at Rs2,175 crore, while the consolidated order book of the group stood at USD1.3 billion. We expect the order inflow to pickup from Q4FY2008 onwards.

On a consolidated basis, the company reported net sales of Rs1,713.5 crore, while the net profit was at Rs82.7crore. The consolidated operating profit margin (OPM) increased by 80 basis points quarter on quarter (qoq) to 10.9%. An year-on-year (y-o-y) comparison could not be made, as the quarterly consolidated numbers were not reported earlier.

We have downgraded our earnings estimates by 8.8% and 4% respectively for FY2008 and FY2009. Our revised earning per share (EPS) estimates now stands at Rs10.6 and Rs14.4 for FY2008 and FY2009 respectively.

We remain bullish on the stock and reiterate Buy recommendation with a revised price target of Rs423. We have valued CGL based on 23x FY2010E EPS, which is based at 15% premium to our target multiple of Thermax.

CGL is one of the largest players in the power sector and with the acquisition of Pauwel, Ganz, and Microsol has plugged the gaps in its products and services offerings. We believe these valuations are attractive because of (a) Robust operating performance of the company on a standalone basis; (b) Higher geographical width and product depth of the company due to its subsidiaries and (c) Management's expertise in turning around the operations of the subsidiaries. At the current market price, the stock trades at 21.7x and 17x its FY2009E and FY2010E consolidated earnings.

The net sales of Deepak Fertilisers & Petrochemicals Corporation (DFPCL) for Q3FY2008 increased by 12.6% year on year (yoy) to Rs274 crore. The chemical division and the fertiliser division contributed 76% and 24% respectively to the net sales. The revenues from the chemical division increased by 27.6% yoy to Rs211.6 crore on the back of a strong contribution from isopropyl alcohol (IPA), while the sales of the fertiliser division dropped by 19% yoy to Rs68.3 crore due to the reduced availability of phosphoric acid in the international market and the lower availability of the same for trading.

The operating profit during the quarter grew by 11% yoy to Rs45.1 crore. Lower sales realisation for methanol offset the strong performance of IPA, thereby declining the overall operating profit margin (OPM) by 20 basis points to 16.5%. The segmental profit before interest and tax (PBIT) for the chemical division reduced by 1.4% to Rs52.4 crore with the margin declining from 32.1% to 24.8%. The loss in the fertiliser division dropped to Rs5.5 crore from Rs13.5 crore. Increased raw material cost including that of outsourced ammonia and propylene decreased the segmental PBIT margin for the chemical division, while the higher price realisation for fertilisers reduced the segmental loss.

The interest expenses were higher by 55% yoy due to increased outstanding debt issued for new projects and capacity expansions. The depreciation charge also increased by 3% yoy during the quarter.

The adjusted profit after tax (PAT) declined by 1.1% yoy to Rs24.6 crore with the margin reducing by 120 basis points to 9.0%. The effective tax rate increased during the quarter as the company has no carry-forward losses this year.

The company has already increased its ammonia capacity to 130,000 tonne per annum (TPA) from 90,000TPA during the second quarter. This along with increased natural gas availability and additional ammonia storage tank would help the company in reducing the raw material cost and enhancing its nitric acid capacity.

Dahej-Uran pipeline is complete and tested. The company is in the process of negotiating a long-term gas supply contract and is expected to finalise the same by Q1FY2009. Improved supply of natural gas to Taloja plant would help in replacing naphtha for steam generation. Spot liquid natural gas at around $12-14 per Million British Thermal Units (MMBTU) would cost almost half the price of naphtha ($22 per MMBTU).

The company has started setting up the ammonium nitrate plant at Paradeep (Orissa). The civil and construction work of the plant is complete and orders for various equipment have been placed. The set-up cost of the plant has increased to Rs500 crore from Rs400 crore estimated earlier. The 300,000TPA plant is expected to be operational in H2FY2008.

The company's specialty mall Ishanya (for interiors and exteriors) commenced its operations during the quarter, ahead of the festive season. The company has already leased out nearly 80% of the 550,000 square feet leasable area at an average rental price of Rs46 per square foot.

At the current market price of Rs118, the stock is trading at 7.6x its FY2009E earnings and at an enterprise value (EV)/earnings before interest, depreciation, tax and amortisation (EBIDTA) of 5.7x. The improved supply of natural gas would benefit the fertiliser division in the coming years, while its ammonium nitrate project would also start contributing from H2FY2010. In view of future earnings visibility, Ishanya, the company's specialty mall for interiors and exteriors is valued at Rs28.7 per share. Due to the delay in the gas supply, we are downgrading our FY2009 profit estimates to Rs137.8 crore from Rs150 crore earlier. We maintain our Buy recommendation on the stock with a revised price target of Rs169.

Grasim Industries' (Grasim) Q3FY2008 net sales increased by 15.4% year on year (yoy) to Rs2,630 crore, mainly on the back of higher realisations from Viscose Staple Fibre (VSF) and sponge iron businesses.

The operating profit margin (OPM) improved by 340 basis points to 32.6%, mainly on account of higher realisations from VSF and sponge iron businesses. Consequently the operating profit was up 29% yoy to Rs856.3 crore.

The reported profit after tax (PAT) was up by a robust 34.6% yoy to Rs553.79 crore because of a healthy growth reported across all the segments namely cement, VSF, sponge iron and caustic soda.

The company's expansion plans are on track for both cement and VSF businesses. The company is adding about 9 million tonne per annum (MTPA) of cement capacity by Q2FY2009 and about 95,000 tonne of VSF capacity, of which 64,000 tonne is expected to come by March 2008. The company has also announced a Rs840-crore greenfield plant with 88,000 tonne VSF capacity.

The management has hinted at a possible buyback, which will be a positive trigger for the stock.

Considering the better-than-expected nine month consolidated performance, we are upgrading our profit estimate by 9.4% and 8.0% for FY2008 and FY2009 respectively. At the current market price of Rs2,736 the stock is trading at 9.4x its estimated FY2008 earnings per share (EPS) and 10.8x its estimated FY2009 EPS. We maintain our Buy recommendation on the stock with a revised price target of Rs3,853 based on our sum-of-the-parts valuation.

HDFC Bank's Q3FY2008 results have been better than expectations. The profit after tax (PAT) grew by 45.2% to Rs429.4 crore compared with our estimate of Rs406.6 crore. The PAT growth, of 45.2% year on year (yoy), for the quarter was also much higher than the steady 30-31% growth in the PAT the bank has been delivering quarter after quarter (Q2FY2008 growth was 40.2% and Q1FY2008 growth was 34.2%).

The net interest income (NII) grew by 65.6% yoy and 23.6% quarter on quarter (qoq) to Rs1,437.6 crore. The year-on-year (y-o-y) growth in the NII was due to an average asset growth of 43.9% yoy and a 55-basis-point improvement in the calculated net interest margins (NIM) to 4.5%.

The non-interest income growth was 81.9% yoy and 40.7% qoq mainly due to a spike in the treasury gains coupled with a robust growth in the fee income. The treasury income reached Rs132 crore compared with a loss of Rs21 crore for the year ago period, while the fee income grew by 38.8% yoy and 17.4% qoq.

The operating profit grew by 67.5% yoy and 29% qoq to Rs1,066.4 crore, while the core operating profit (operating profit excluding the treasury income) was up 42.2% yoy to Rs934.9 crore.

Provisions and contingencies were up sharply to 105.4% yoy and 46.2% qoq to Rs423.1 crore, in line with the bank's focus on unsecured retail portfolio such as personal loans, credit cards etc, which offer higher yields.

The bank's advances grew by 48.7% yoy and 14.6% qoq to Rs71,387 crore and the deposits grew by 48.9% yoy and 9.1% qoq to Rs99,387 crore. The bank displayed a strong business growth despite the difficult environment during the last five-six month period.

The bank reported a 45.2% PAT growth for the quarter, which is much higher than the steady 30-31% growth in the PAT the bank has been delivering quarter after quarter. The business growth continued to remain robust with superior asset quality and margins compared with that of the industry. The bank has delivered a strong set of numbers and maintained or improved on most parameters amidst a difficult environment.

We therefore continue to like HDFC Bank as a true evergreen stock under most circumstances. At the current market price of Rs1,548 the stock is quoting at 27.6x FY2009E earnings per share (EPS), 10.4x FY2009E pre-provision profit (PPP), and 4.1x FY2009E book value (BV). We maintain our Buy recommendation on the stock with an increased 12-month price target of Rs1,747 (earlier price target was Rs1,694). We have raised the price target after factoring in the higher growth momentum, which the bank is experiencing this year. Our net profit forecast has increased by 1.5% for FY2008E and 1.7% for FY2009E.

Hindustan Unilever Ltd's (HUL) Q4CY2007 results are in line with our estimates. The net sales grew by 16.8% year on year (yoy) to Rs3,687.4 crore. The sales growth was driven by strong performance of both the home & personal care (HPC) and food segments, which grew by 18.6% and 17.4% respectively on a year-on-year (y-o-y) basis.

The soaps & detergents business put up a strong show with sales growth of 18.3% yoy to Rs1,689 crore and the profit before interest and tax (PBIT) margin of 17.2% (up by 165 basis points yoy). The personal care products business that had been a laggard for the last four quarters reported a strong growth of 19.1% yoy on account of a low base effect. The PBIT margin for the segment stood at a hefty 33.4% (up by 153 basis points yoy).

The operating profit margin (OPM) as a whole declined by 54 basis points to 15.3% yoy, mainly due to the increase in employee expenses by 46% yoy to Rs194.5 crore and the rise in advertising and selling cost by 32.3% yoy to Rs375.9 crore. The raw material cost as a percentage to sales showed a substantial decline of 270 basis points to 51.5%. Hence the operating profit increased by 12.8%yoy to Rs564.2 crore.

Other income increased by 49.3% yoy to Rs159.7 crore leading the earnings before interest, depreciation, tax and amortisation (EBIDTA) to increase by 19.3% to Rs723.9 crore.

Consequent to the higher tax rate of 19.1% during the quarter as against 15.3% in Q4CY2006, the adjusted net profit was up by 14.6% to Rs554 crore, which is in line with our estimate of Rs569.8 crore.

While competitive pressures to maintain the market share in its flagship HPC segment are on the rise coupled with input cost inflation, we are pleased that HUL is exploring ways by expanding its presence into premium personal care products to maintain the growth in HPC segment. At the current market price of Rs203, the stock trades at 21.8x its CY2008E earnings per share (EPS) of Rs9.30. We maintain our Buy recommendation with price target of Rs280.

ICI India's sales growth of 14.5% year on year (yoy) to Rs256.7 crore is as per our expectations. The paints segment registered a like-to-like growth (excluding Q3FY2007 sales of Advanced 2K refinish paints that was hived off in March 2007) of 22% yoy. The chemicals segment continued the impressive growth with a 24.8% year-on-year (y-o-y) growth in the sales for the quarter.

The operating profit margin (OPM) for the quarter under review stood at 14.9% against 15.6% in Q3FY2007. The operating profit thereby increased by 9.3% yoy to Rs38.3 crore on account of a good top line growth.

The other income was lower at Rs0.6 crore against Rs7.7 crore in Q3FY2007, as the company has invested its huge pile of cash (~Rs650 crore) mostly in fixed maturity plans, wherein the returns are accounted on cash basis (on receipt basis) leading to an erratic quarter-on-quarter (q-o-q) other income. The adjusted net profit therefore grew only by 7.2% yoy to Rs25.2 crore.

As against the expectation that the takeover of ICI Plc by Akzo Nobel (completed on January 2, 2008) would trigger an open offer to the shareholders of ICI India, the Securities and Exchange Board of India (SEBI) has made it clear that Akzo Nobel is not under an obligation to make an open offer, as this is an indirect acquisition under a scheme of arrangement.

In light of the nine-month performance of ICI India, we have revised our estimates for FY2008. This is primarily on account of much lower other income, as the company accounts for income from fixed-maturity plans on receipt basis that leads to a big variance in the yearly other income due to maturity of these investments bunching up in a few years.

We remain positive on ICI India primarily on account of good prospects for paints industry, synergies that would arise on concerted efforts of Akzo Nobel in growing ICI India's business and a huge pile of cash (~Rs650 crore) that opens up opportunities for organic and inorganic growth.

At the current market price of Rs495, the stock trades at 20.8 x its FY2008E earnings per share (EPS) of Rs23.8 and 15.7x FY2009E EPS of Rs31.6. We maintain our Buy recommendation on the stock with a price target of Rs581.

Please note that Q3FY2008 numbers are standalone numbers, which does not give a complete picture, as the company's major SEZ projects (Chennai and Jaipur SEZ projects) are executed through its subsidiaries. The consolidated numbers are eported on an annual basis.

Mahindra Lifespace Developer's (MLD) revenues grew by 3.8% year on year (yoy) to Rs43.4 crore in Q3FY2008. During the quarter, the revenues were booked from Mahindra Eminente in Goregaon, Mahindra Royale in Pune and Sylvan County in Chennai. In M9FY2008, MLD's revenues declined by 7.4% yoy to Rs112.5 crore, due to delay in the projects launches for the standalone properties in the previous quarters.

The operating profit margin (OPM) contracted by 329 basis points yoy to 19.1%. Consequently, the company's operating profit declined by 11.5% yoy to Rs8.3 crore.

MLD's net income grew by 17.6% yoy to Rs11.2 crore primarily due to the increase in the other income to Rs5.2 crore in Q3FY2008 from Rs3.1 crore in Q3FY2007. The other income rose on account of higher interest income generated on cash surplus. In M9FY2008, MLD's net income grew 175.8% yoy to Rs10.6 crore primarily due to higher other income on account of dividend income received from its subsidiary, Mahindra World City Developers.

Mold-Tek Technologies' (MTT) Q3FY2008 results were in line with our expectations. The net sales increased by 15.3% year on year (yoy) to Rs24.1 crore. The contribution of the KPO (Knowledge Process Outsourcing) division to the total revenues of the company increased to 20.5% from 14.3% during the same quarter last year. The revenues from the plastics division increased by 6.6% yoy to Rs19.1 crore, while the sales from the KPO division increased by 67.9% yoy to Rs5 crore.

The operating profit margin (OPM) increased to 18.4% from 16.5% during the same quarter last year on account of an increased contribution from the KPO division. Consequently, the operating profit rose by 28.3% to Rs4.4 crore. The segmental profit before interest and tax (PBIT) for the plastics division increased by 28.2% to Rs1.4 crore with the margin expanding by 110 basis points to 7.2%. The PBIT for the KPO division increased by 55.4% to Rs2.6 crore.

The interest costs increased by 8.2% to Rs53 lakh, while the depreciation rose by 12.7% to Rs80 lakh. Modest increases in interest and depreciation costs resulted in a 52.6% growth in the net profit to Rs3.5 crore.

Pursuant to the order of high court of Andhra Pradesh, the de-merger scheme has been approved by the shareholders. The de-merger of the company into two separate entities is expected to unlock value in the KPO business, as it is currently valued in line with the plastics business, where the margins are quite low compared to the KPO business.

MTT has gained size and expertise required to carve its niche within structural engineering KPO business. The company has also taken inorganic growth path to increase its presence in the key overseas markets. Consequently, we estimate the KPO business to grow at a compounded annual growth rate (CAGR) of over 150% till FY2010 including growth through acquisitions.

At the current market price of Rs103, the stock is trading at 5.5x its FY2009E earnings. We maintain our Buy recommendation on the stock with a revised price target of Rs197.

Navneet Publication Ltd's (NPL) Q3FY2008 results are ahead of expectations. The net sales grew by a robust 29.2% year on year (yoy) to Rs59.1 crore on account of healthy growth in the stationery business, which grew by 38.6% yoy to Rs22.7 crore.

Though the turnover of the stationery business increased, the profits from the business did not increase proportionately on account of additional sales promotion cost of Rs1.1 crore. However, the company expects to benefit from these sale promotion activities going forward.

The operating profit margin (OPM) declined marginally by 39 basis points to 13.3%. This was mainly because of the increase in the other expenditure, which grew by 33.6% to Rs12.61 crore. The operating profit increased by 25.5% to Rs7.87 crore in Q3FY2008 from Rs6.27 crore in Q3FY2007.

The increase in depreciation by Rs99 lakh was mainly on account of windmills, which started operating from September 2007. Higher depreciation and interest expenses led to a much lower growth of 7.7% yoy in the profit after tax (PAT) to Rs3.64 crore.

Going forward the publication segment, which is one of the major contributors (63% of the total revenue) to the topline of the company, will achieve a flat growth, as syllabi is no more being revised in the schools of Gujarat and Maharashtra. The flat growth of the publication segment would however be offset by some of its new initiatives such as non-paper stationery products, introduction of Urdu publication and e-learning business, which would drive the growth for NPL in near future. Grafalco, its Spanish subsidiary, has performed as per expectation showing a growth of 81% in its revenues to Rs11.6 crore.

Labels:

Company Info,

Stock Recommendations

Please note: Some of the content in this site is from Share khan emails sent to its customers.