Marico Exiting from non-focus business Key points

Recommendation: Buy

Price target: Rs70

Current market price: Rs63

Live Online Trading News, Live Online Stock Prices NSE, BSE, Live Online Stock Recommendations

www.mReach.net ... for Live TV, Radio & FM channelswww.mReach.netFor Live TV, Radio & FM channels |

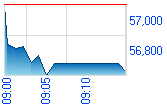

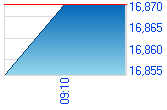

Live BSE Live NSE

|

Thursday, March 13, 2008

Stock Recommendations: 4

Marico has exited from its processed food business by divesting its brand Sil to Scandic Food Pvt Ltd, the Indian subsidiary of Good Food Group A/S.

Sil, the no.2 brand in jams (no.1 is Hindustan Unilever’s Kissan) in India, has a market share of 8%. The brand was part of Marico’s non-focus portfolio, contributing around 1% to the total turnover of the company.

The company is aiming at rationalising its portfolio, so that it can focus on the beauty and wellness segment. This divestment will help Marico to focus on its core beauty and wellness portfolio.

Marico's business model has multiple revenue drivers that make us bullish on the company's prospects. The company also has a strong foothold in the domestic haircare and edible oil markets. In the absence of details of the deal, we would revise our estimates as and when the details are available to us. We remain positive on Marico’s businesses and maintain our Buy recommendation on the stock with a price target of Rs70. At the current market price of Rs63, the stock is trading at 18.9x its FY2009E earnings per share (EPS) of Rs3.34.

Labels:

Company Info,

Stock Recommendations

Please note: Some of the content in this site is from Share khan emails sent to its customers.