Trade Recommendation:: Ranbaxy Laboratories Ranbaxy settles on Nexium; price target revised to Rs625 Key points Trade Recommendation:: Infosys Technologies Result highlights Trade Recommendation:: Zee News Q4FY2008 results: First-cut analysis Result highlights Trade Recommendation:: HCL Technologies Q3FY2008 results: First-cut analysis Result highlights

Trade Recommendation: Buy

Price target: Rs625

Current market trading price: Rs482

Trade Recommendation: Buy

Price target: Rs1,940

Current market trading price: Rs1,510

Recommendation: Buy

Price target: Rs79

Current market price: Rs57

Trade Recommendation: Buy

Price target: Under review

Current market trading price: Rs246

Live Online Trading News, Live Online Stock Prices NSE, BSE, Live Online Stock Recommendations

www.mReach.net ... for Live TV, Radio & FM channelswww.mReach.netFor Live TV, Radio & FM channels |

Live BSE Live NSE

|

Friday, April 18, 2008

Trade Recommendation: Ranbaxy Laboratories, Infosys, Zee News, HCL

Ranbaxy Laboratories (Ranbaxy) has entered into an out-of-court settlement relating to the launch of generic Nexium, Astra Zeneca's blockbuster drug for gastroesophageal reflux disease.

Under the terms of the settlement, Ranbaxy can launch generic Nexium in the USA on May 27, 2014 with a 180-day exclusivity. This is ahead of the drug's patent expiry in 2018. Further, Ranbaxy will also supply a significant portion of Astra Zeneca's requirement for Nexium in the USA from May 2010 onwards and supply esomeprazole magnesium (the active pharmaceutical ingredient for Nexium) from May 2009 onwards.

In a separate agreement, Ranbaxy has also been designated as the authorised generic player for two older Astra Zeneca products--the heart drug Plendil, or felodipine, and the 40mg version of ulcer pill Prilosec, or omeprazole. Ranbaxy will be compensated for its distribution services on standard commercial terms.

Nexium clocked revenues of $5.2 billion in 2007 and is Astra Zeneca's biggest product. Using the discounted cash flow (DCF) approach, we value Ranbaxy's Nexium deal with Astra Zeneca at Rs70 per share.

We are upgrading our price target for Ranbaxy to reflect the value of the Nexium opportunity. We continue to maintain our earnings estimate at the previous levels for the base business. Hence we arrive at a revised price target of Rs625 (20x CY2009E earnings of base business plus Rs135 for exclusivity opportunities).

Clarity on the launch of generic Lipitor both in the USA as well as in the other world markets, along with news flow on further Para IV first-to-file (FTF) opportunities, would act as trigger for the stock. At the current market price of Rs482, Ranbaxy is trading at 22.5x its base CY2008E and 19.7x its base CY2009E earnings (excluding exclusivity opportunities). We maintain our Buy recommendation on the stock with a revised sum-of-the-parts price target of Rs625.

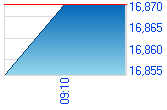

Infosys Technologies (Infosys) reported a revenue growth of 6.3% quarter on quarter (qoq) and 20.4% year on year (yoy) to Rs4,542 crore during the fourth quarter. The sequential growth in the revenues was contributed by a volume growth of 4.9% in its consolidated information Technology (IT) service business, an increase of 0.2% in its blended realisation and a depreciation of 0.9% in the rupee.

The operating profit margin (OPM) decreased by 10 basis points qoq to 32.5% in Q4FY2008. The operating profit grew by 6.2% qoq to Rs1,478 crore.

The other income component declined to Rs139 crore in Q4FY2008 from Rs158 crore during the corresponding period last year primarily due to a foreign exchange (forex) fluctuation loss of Rs45 crore during Q4FY2008 as compared to a relatively lower loss of Rs14 crore in Q3FY2008. The company also recorded a tax reversal of Rs20 crore during the quarter compared to Rs51 crore in Q3FY2008. This led to a 1.5% quarter-on-quarter (q-o-q) increase in the net income to Rs1,249 crore. After adjusting for these tax reversals, the company's earnings grew by 4.2% sequentially to Rs1,229 crore.

The company announced a final dividend of Rs7.25 per share and a special dividend of Rs20 per share. The company also intends to increase its dividend payout ratio from 20% to 30% of the net profit.

In terms of guidance for FY2009, the revenues are guided to grow by 19% to 21% and the earnings are guided to grow 16.7% to 18.7% in dollar terms (Rs92.3-93.9 per share in rupee terms). This is in line with our expectation and higher than street expectations. However, the guidance for Q1FY2009 is quite muted. In rupee terms, the revenues are guided to remain flat sequentially (with a growth of less than 1%), whereas the earnings are expected to decline sequentially to Rs20.7 per share (down from 3.5% sequentially).

In terms of demand environment, the management indicated that 76% of its clients expect their IT budget to decline or remain flat. Moreover, the company is also witnessing some deal cancellation in the retail vertical. On the positive side, there has not been any cancellation of projects in the Banking Financial Services & Insurance (BFSI) vertical.

We have revised our earning estimates for FY2009 downward by 2.6% on account of lower other income, as the company plans to increase its dividend payout ratio. We have also introduced FY2010 estimates and expect the company's earning to grow by 4.8% to Rs99.8 per share. The lower earning growth rate will be primarily due to an increase in the effective tax rate from 15% in FY2009 to 22% in FY2010 due to withdrawal of Software Technology Park of India (STPI) benefits. At the current market price, the stock is trading at 15.9x FY2009 earning estimates and 15.1x FY2010 earning estimates. We maintain Buy recommendation on the stock with revised price target of Rs1,940.

Zee News has delivered a blow-out performance for Q4FY2008. Beating our and consensus estimates the revenue from its operations grew by a robust 59.1% year on year (yoy) to Rs113.1 crore in the quarter. The net profit after minority interest zoomed multifold to Rs15.3 crore during the same period.

The advertising revenues soared by 84% yoy to Rs86 crore while the subscription revenues that had grown by a meagre 7.6% in M9FY2008 grew by 49.7% yoy and 36.3% quarter on quarter (qoq) to Rs22 crore. A break-up of its channels into the existing and new businesses shows that the revenues from the existing businesses grew by a handsome 53% yoy whereas the new businesses recorded a 153% growth in their revenues.

The operating profit margin for the quarter stood at 23.7% against -1.3% for Q4FY2007. Thus the operating profit grew to Rs26.8 crore against an operating loss of Rs0.9 crore in Q4FY2007. The improvement in the margins of the existing businesses continued and stood at 37.2% for the quarter. The operating loss for the new businesses declined from Rs15.3 crore in Q4FY2007 to Rs10.1 crore.

Zee Marathi and Zee Bangla, which are number one channels in their respective genres, increased their gross rating points (GRPs) by 35.7% and 18.5% respectively over Q4FY2007 whereas Zee Telugu and Zee Kannada, which form a part of the new businesses, increased their GRPs by 74.3% and 123.4% respectively. We believe that with the continuous gain in viewership the new businesses would break even in FY2009.

The company will launch Zee Tamil by the end of July 2008 against which it has charged Rs1.39 crore as expenses in the quarter. The south Indian regional entertainment diaspora is highly competitive. However, considering the Zee group's established track record in entertainment and the size of this market, we remain positive on Zee News' prospects in these markets. We believe that its entertainment channels in the southern regional languages remain the key drivers of its growth in the longer term.

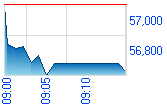

At the current market price of Rs57.2 the stock trades at 18.6x its FY2010E earnings per share of Rs3.1 and at FY2010E market cap/sales of 2.6x. We maintain our Buy recommendation on the stock with our price target of Rs79.

HCL Technologies has reported a revenue growth of 7.1% quarter on quarter (qoq) and 23.3% year on year (yoy) to Rs 1,944.8 crore for the third quarter ended March 2008. In dollar terms, it has reported a sequential growth of 5.2% in its consolidated revenues to $484.9 million. The sequential growth in the revenues was driven by a volume growth of 6.6% (a 5.3% growth in software services, a 8.5% growth in IMS and 4.5% growth in BPO services), which was partially mitigated by the adverse impact of offshore shift (0.3%) and lower material billing in the IMS business (1.1%) during the quarter.

The operating profit margin (OPM) improved by 88 basis points to 22.3% on a sequential basis. The margin improvement was aided by higher realisations (7 basis points), hedging gains (22 basis points), revenue mix (26 basis points) and efficiency gains (48 basis points). This positive affect was however partially offset by higher infrastructure expenses of around 10 basis points.

In terms of segments, the earnings before interest, tax, depreciation, and amortisation (EBITDA) margins of all the three business lines improved on a sequential basis. The IMS and software services businesses reported margin improvement of 113 basis points and 93 basis points sequentially. The BPO services reported a 16 basis-point sequential improvement in its margins.

However, the foreign exchange (forex) losses of Rs27.1 crore as compared to forex gains of Rs5.8 crore in Q2FY2008 resulted in a relatively lower earning growth of 2.9% quarter on quarter (qoq) to Rs342.5 crore. This is largely in line with our estimates.

In terms of operational highlights, the company has signed deal worth $500 million during the quarter. However, it has maintained its full year revenue growth guidance of around 35% implying a relatively muted sequential growth in Q4FY2008. This is largely due to a slowdown in business from two of its top 10 clients as fallout of the scenario in the USA. Moreover, the company added just 1,848 employees in Q3FY2008 and has scaled down the recruitment target to 9,000 employees in FY2008 (down from 12,000 employees earlier).

At the current market price, the stock trades at 13.3x FY2008 and 10.3x FY2009 estimated earnings. We maintain our Buy recommendation on the stock, but would revise the earning estimates and price target in the detailed update.

Please note: Some of the content in this site is from Share khan emails sent to its customers.