Trade Recommendation:: BASF India Agro products boost revenues Result highlights Trade Recommendation:: Esab India Annual report review Key points

Trade Recommendation: Buy

Price target: Rs330

Current market trading price: Rs210

Trade Recommendation: Buy

Price target: Rs575

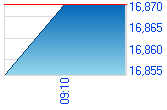

Current market trade price: Rs432

Live Online Trading News, Live Online Stock Prices NSE, BSE, Live Online Stock Recommendations

www.mReach.net ... for Live TV, Radio & FM channelswww.mReach.netFor Live TV, Radio & FM channels |

Live BSE Live NSE

|

Friday, April 18, 2008

Stock Recommendation: BASF India, Esab India

The stand-alone Q4FY2008 results of BASF India (BASF) are in line with our expectations. The net sales of the company grew by 20.3% year on year (yoy) to Rs193.4 crore, mainly driven by a strong 29.6% growth in the sales of agricultural products and a 20.2% growth in the sales of performance products. The plastic division’s sales also grew by a healthy 18.1%.

The operating profit margin (OPM) during the quarter remained flat at 5.1% yoy. The margin for the performance product and chemical divisions improved while the same for the agricultural product and nutrition division, and the plastic division declined during the quarter. Consequently, the operating profit grew by 18.5% to Rs9.8 crore in Q4FY2008.

Despite increased interest and depreciation charges, the company’s net profit increased by 20.2% to Rs4.4 crore during the quarter.

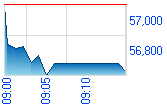

For FY2008, the consolidated net sales grew by 24.5% to Rs1,053.6 crore and the profit after tax (PAT) grew by 14.8% to Rs57.5 crore on the back of the solid performance by the agricultural product and nutrition division during the year.

We expect the consumption boom in the company’s user industries (white goods, home furnishings, paper, construction and automobiles) to continue and hence we remain optimistic about the company’s growth prospects.

We believe the stock is trading at attractive valuations of 6.9x FY2009E consolidated earnings and an enterprise value (EV)/earnings before interest, depreciation, tax and amortisation (EBIDTA) of 3.9x. We maintain our Buy recommendation on the stock with a price target of Rs330.

For CY2007 ESAB India has reported a healthy 19.4% growth in its sales and a 25.2% rise in its profits. The company continues to grow at a robust rate owing to the government’s thrust on infrastructure development. ESAB India remains a leader in the welding products industry.

The consumables business recorded a growth of 16.7% for the full year on account of a good volume growth with marginally better realisations except for the wire segment where price continues to be under pressure. The equipment business reported an increase of 26.8% in revenues while its earnings before interest and tax (EBIT) margin reported a healthy increase of 360 basis points on account of operating leverage. Overall, the company improved its operating profit margin (OPM) by 70 basis points to 23.3%.

During the year, Charter Plc, its parent company, increased its stake in ESAB India by acquiring shares from the open market at a price of Rs505 per share, taking the total holding to 55.56% from 37.31% earlier.

The outlook on ESAB India remains positive. The hectic activity in India's core infrastructure sectors, like roads, ports, airports and construction, and the other industrial sectors are expected to drive the volumes for the welding industry. Being the market leader ESAB India is expected to make the most of this boom. We maintain our Buy recommendation on the stock with a price target of Rs575.

Labels:

Stock Recommendations

Please note: Some of the content in this site is from Share khan emails sent to its customers.