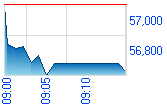

Jindal Saw

Cluster: Emerging Star

Recommendation: Buy

Price target: Rs1,302

Current market price: Rs904

Entering new territories

Result highlights

- Jindal Saw Ltd's (JSL) Q5FY2007 numbers were ahead of our expectations on the back of higher topline and improved margins. The net revenues marked a growth of 35.1% year on year (yoy) to Rs1,611.7 crore due to high growth witnessed in the submerged arc welded (SAW) pipe and the ductile iron (DI) pipe segments.

- The US division, which contributed Rs535 crore to the topline during the quarter, has been hived off. Since the US division was operating at lesser margins of about 8-9%, its hiving off would result into an expansion in the company's profit margins.

- On the back of a favourable product mix, lesser contribution of the US division, and greater efficiencies, the operating profit margin (OPM) expanded by 100 basis points yoy and 50 basis points sequentially to 12.4%. Consequently, the operating profits surged by 46.3% to Rs199.8 crore. Lower taxes led the profit before extraordinaries to grow by 83.1% to Rs110.1 crore.

- JSL's order book at the end of the quarter stood at $1 billion executable by January 2009, with more than 65% contribution coming from international markets. Of this, $775 million orders were for SAW pipes, while the remaining orders were for DI and seamless pipes.

- The company has announced new initiatives and has identified opportunities in new areas of infrastructure, transportation and fabrication industry, all through wholly owned subsidiary Jindal ITF. In all, the capital expenditure (capex) of Rs1,800 crore is planned to be spent on these businesses with 25% equity contribution.

- To fund these plans, the company would also be issuing 26 lakh warrants and 27.3 lakh convertible debentures to the promoters, convertible at Rs819 per share.

- We are not taking into account the impact of these new initiatives into our numbers currently and would await more clarity on the same. However, we do believe that there lies immense potential in these businesses, and the same would also offer higher return on capital than that of the core business.

- We maintain our positive outlook on the company considering strong scope for its core business and margin expansion. We believe the stock is trading at attractive valuations at 9.9x its CY2008E earnings and 5.4x its CY2009E earnings. We maintain our Buy recommendation on the stock with a price target of Rs1,302.

VIEWPOINT

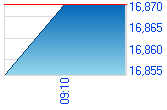

GlaxoSmithKline Pharmaceuticals

Steady growth; fairly valued

GlaxoSmithKline Pharmaceuticals (GSK Pharma) recently announced its Q4CY2007 and CY2007 results. The company also held an analyst meet post the result announcement to discuss its financial performance and throw light on the key strategic initiatives for the future. We present the highlights of the same.